Estate Income Tax Rates 2024

Estate Income Tax Rates 2024. Below are the tax rates and income brackets. Estate income tax rates in 2024.

For 2024, the federal estate tax threshold is $13.61 million for individuals, which means married couples don’t have to pay estate if. Ireland has the highest top dividend tax rate among the covered european countries at 51 percent.

As Of 2024, Estate Income Tax Rates Are Progressive, Meaning The Percentage Of Income Subject To Taxation Increases As Income Levels Rise.

These include deadlines relating to income.

The Annual Gift Exclusion, Which Is The Amount You Can Gift.

Married couple estate exemption top estate tax rate.

The Estate Tax Ranges From Rates Of 18% To 40% And Generally Only Applies To Assets Over $13.61 Million In 2024.

Images References :

Source: justonelap.com

Source: justonelap.com

Tax rates for the 2024 year of assessment Just One Lap, Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax. The amount of tax is typically determined by the fair.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar, Ireland has the highest top dividend tax rate among the covered european countries at 51 percent. Below are the tax rates and income brackets.

Source: www.urban.org

Source: www.urban.org

Estate and Inheritance Taxes Urban Institute, It is assumed that the only credits claimed are the. Here we give the lowdown on the seven personal finance changes which will come into force from april 1, 2024 onwards.

Source: wcs.smartdraw.com

Source: wcs.smartdraw.com

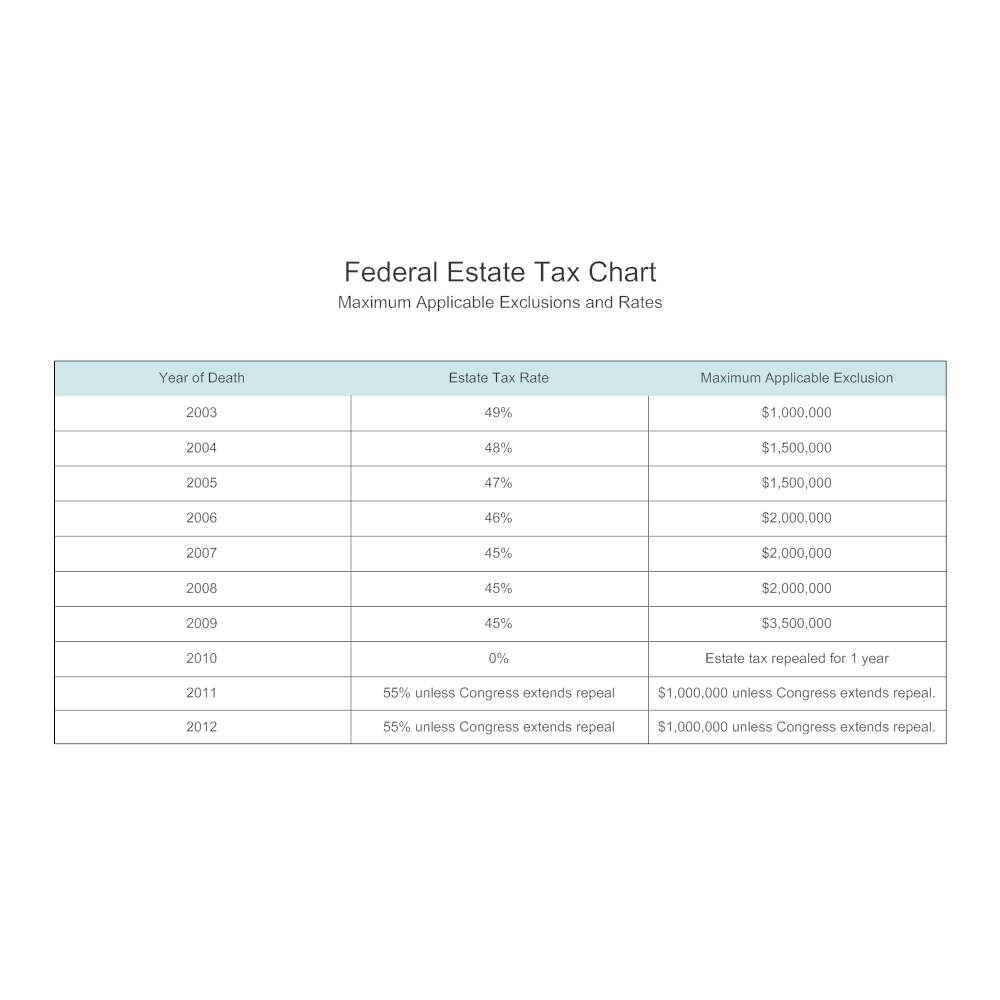

Federal Estate Tax Chart, Denmark and the united kingdom follow, at 42 percent and 39.4. The 0% and 15% rates continue to apply to amounts below certain threshold amounts.

Source: perlaqsybille.pages.dev

Source: perlaqsybille.pages.dev

Taxes By State 2024 Dani Michaelina, Check the tax rates for the first 3 years of the deceased estate, and the rates for later years. For tax year 2024, the 20% rate applies to amounts above $15,450.

Source: atonce.com

Source: atonce.com

Maximize Your Paycheck Understanding FICA Tax in 2024, A sneak peek at the potential 2024 estate and gift tax rates. The estate tax is a tax on your right to transfer property at your death.

Source: dorolisawsusie.pages.dev

Source: dorolisawsusie.pages.dev

2024 Tax Brackets Calculator Nedi Lorianne, The 0% and 15% rates continue to apply to amounts below certain threshold amounts. Investopedia reports cre loans maturing “by the.

Source: incobeman.blogspot.com

Source: incobeman.blogspot.com

Ranking Of State Tax Rates INCOBEMAN, $12,920,000 $25,840,000 40% gift taxes. The estate tax is a tax on your right to transfer property at your death.

Source: topdollarinvestor.com

Source: topdollarinvestor.com

2023 Tax Rates & Federal Tax Brackets Top Dollar, File an estate tax income tax return. Thirteen states levy an estate tax.

Source: pboadvisory.com

Source: pboadvisory.com

2023 Tax Bracket Changes PBO Advisory Group, Additional updates to gifting and 529 planning amounts. The annual gift exclusion, which is the amount you can gift.

For 2024, The Federal Estate Tax Threshold Is $13.61 Million For Individuals, Which Means Married Couples Don’t Have To Pay Estate If.

The 0% rate applies to.

$12,920,000 $25,840,000 40% Gift Taxes.

Individual income taxes are a major source of state government revenue, constituting 38 percent of state tax.