Lifetime Gift Tax Exclusion 2024 Form

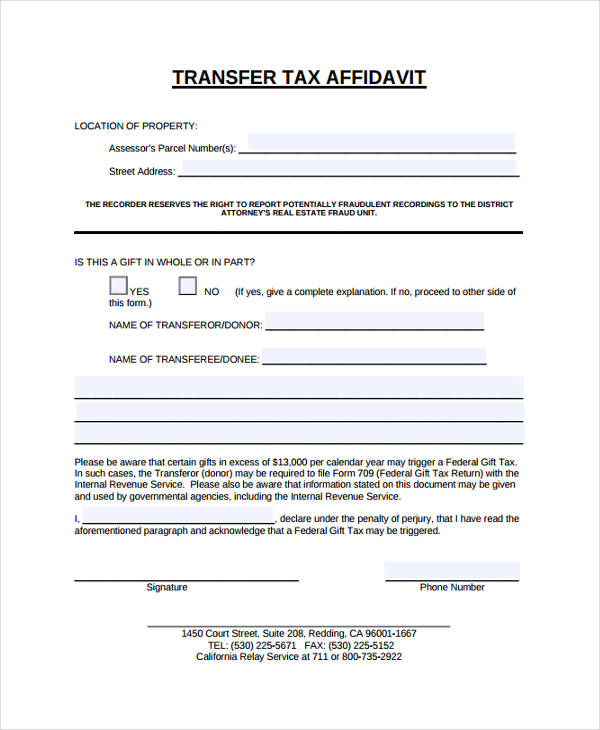

Lifetime Gift Tax Exclusion 2024 Form. If you made substantial gifts this year, you may need to fill out form 709. If you make a taxable gift (one in excess of the annual exclusion), you are required to file form 709:

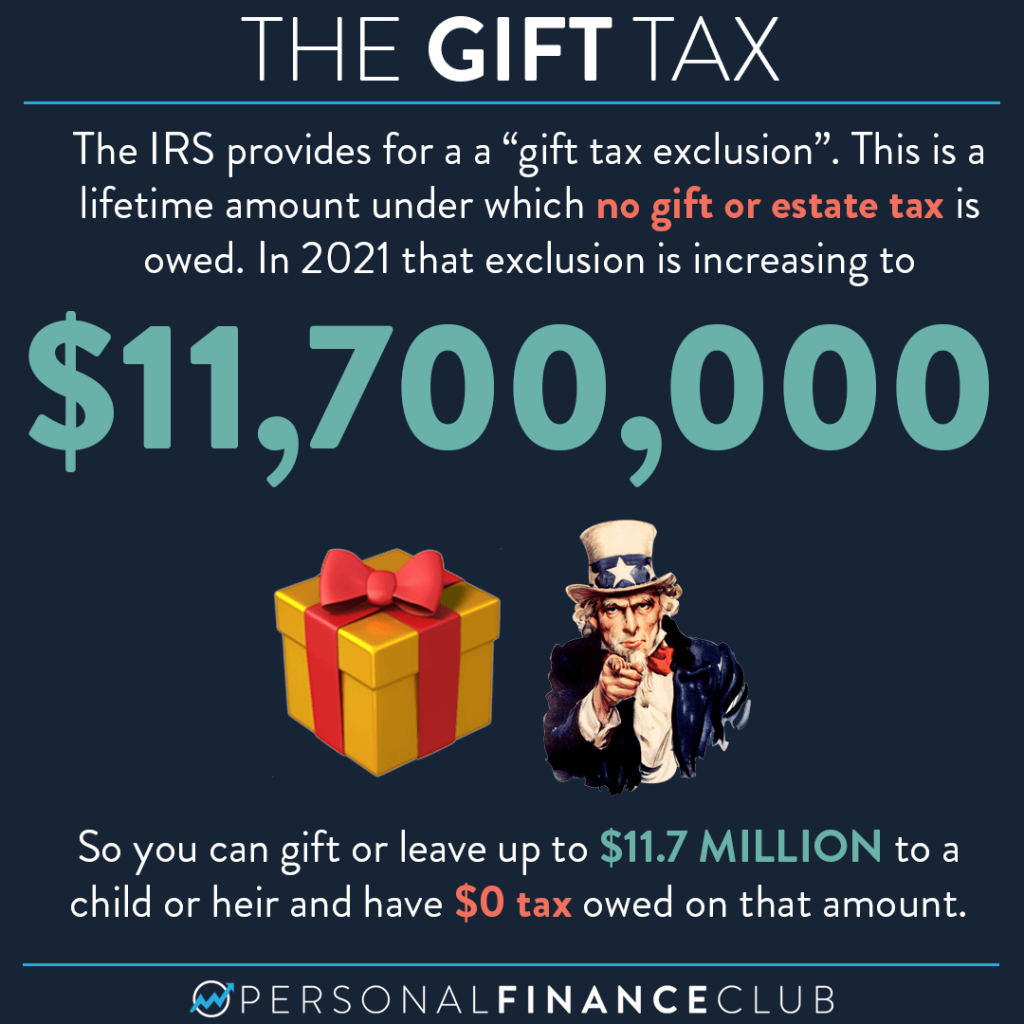

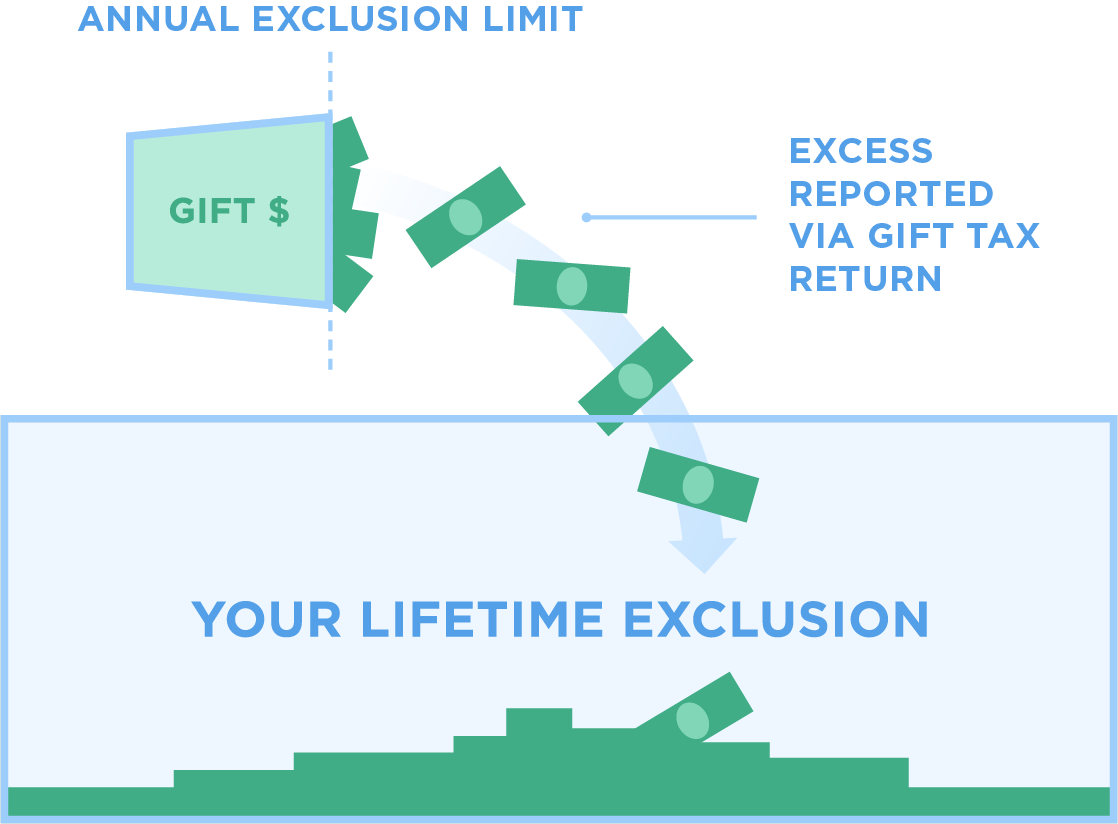

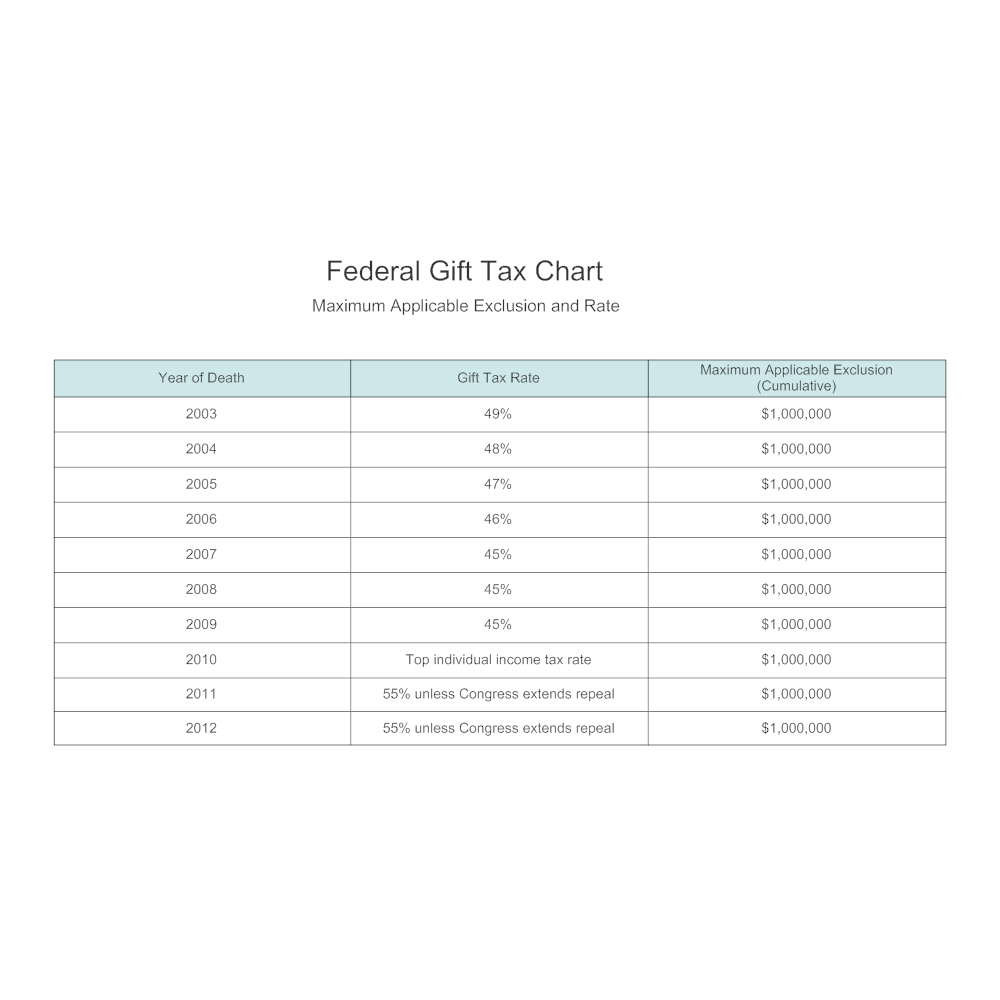

Using the annual gift tax exclusion; The lifetime gift tax exemption is tied to both the annual gift tax exclusion and the federal estate tax.

Lifetime Gift Tax Exclusion 2024 Form Images References :

Source: lanebjoscelin.pages.dev

Source: lanebjoscelin.pages.dev

Lifetime Gift Tax Exclusion 2024 Form Kip Shoshanna, Lifetime gift tax exemption example.

Source: thedayshirline.pages.dev

Source: thedayshirline.pages.dev

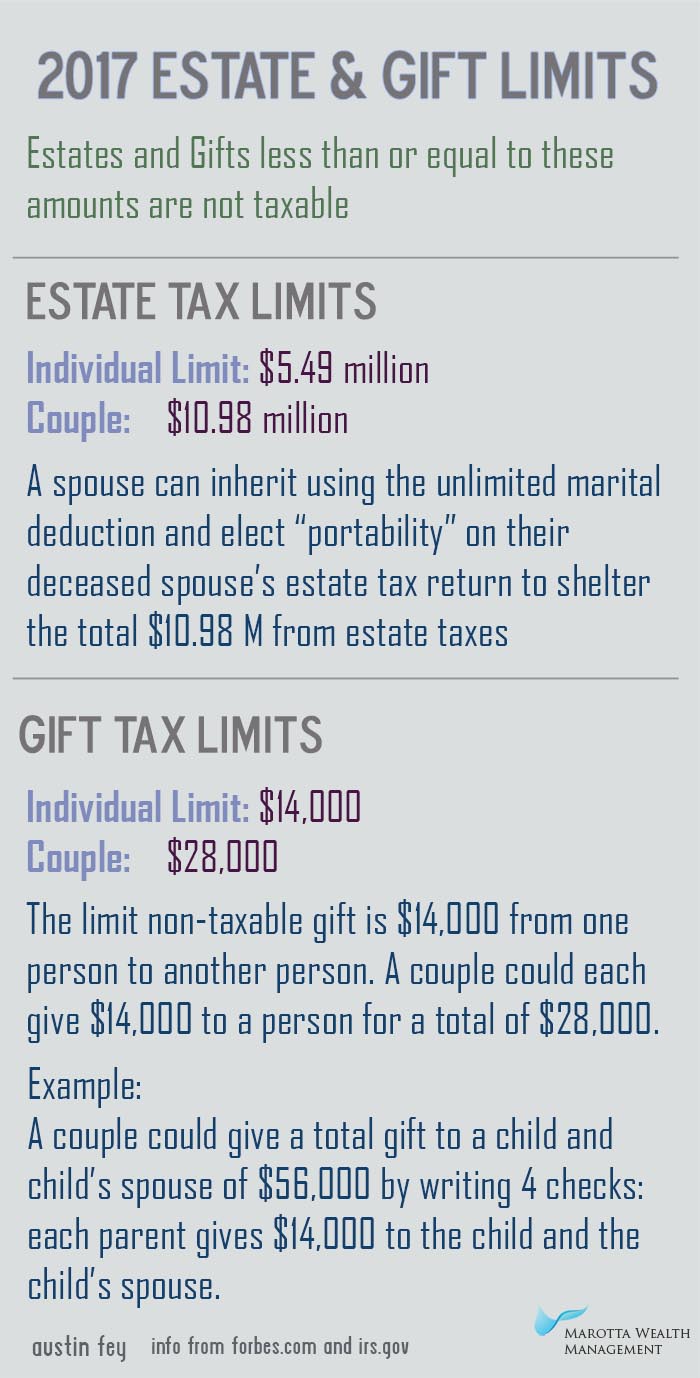

Lifetime Gift Tax Exclusion 2024 Form Denise Tarrah, This limit is called the lifetime, or combined, gift and estate tax exemption.

Source: gabeybardelle.pages.dev

Source: gabeybardelle.pages.dev

Lifetime Gift Tax Exclusion 2024 Pdf Codee Devonna, This credit eliminates federal gift tax liability on the first taxable gifts made in one's lifetime, up to the $13,610,000 exemption amount in 2024.

Source: thedayshirline.pages.dev

Source: thedayshirline.pages.dev

Lifetime Gift Tax Exclusion 2024 Form Denise Tarrah, This limit is called the lifetime, or combined, gift and estate tax exemption.

Source: adinayamabelle.pages.dev

Source: adinayamabelle.pages.dev

Gift Tax 2024 Irs Olga Meaghan, This guide explains how they are all connected.

Source: lanebjoscelin.pages.dev

Source: lanebjoscelin.pages.dev

Lifetime Gift Tax Exclusion 2024 Form Kip Shoshanna, Here's how the gift tax works, along with current rates and exemption.

Source: joyykarisa.pages.dev

Source: joyykarisa.pages.dev

Lifetime Gift Tax Exclusion 2024 Pdf Timmi Giovanna, The annual exclusion amount for 2023 is $17,000 and for 2024 is $18,000.

Source: brenynadiya.pages.dev

Source: brenynadiya.pages.dev

2024 Gift Tax Exemption Amount Aida Shelia, The lifetime gift tax exemption is tied to both the annual gift tax exclusion and the federal estate tax.

Source: ollieyvalery.pages.dev

Source: ollieyvalery.pages.dev

Lifetime Gift Tax Exclusion 2024 Kaile Marilee, This limit is called the lifetime, or combined, gift and estate tax exemption.

Source: meggibmadonna.pages.dev

Source: meggibmadonna.pages.dev

Lifetime Gift Tax Exclusion 2024 In India Lucy Merrie, The 2024 gift tax limit is $18,000, up from $17,000 in 2023.

Posted in 2024